Why Read the Prelim and Title Commitment?

Tuesday, November 24th, 2015 What does the preliminary title report and commitment for title contain?

What does the preliminary title report and commitment for title contain?

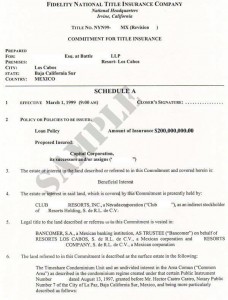

In addition to the findings of the title search, the prelim includes the legal description of the property and this should be checked with the legal description on the sales contract. The sales contract describes the property three ways; the street address, the parcel identification number or the assessor’s number, and the legal description.

There will often be a plat map showing the location and dimensions of the property and often a partial plat map of the subdivision. There may be drawings showing easements of the property on the plat map.

In the description of the property, easements will be described; most property contain utility easements. If there is common property, this too will be noted on the commitment.

If there is a Homeowner’s Association, the commitment will make reference to that fact and indicate where the HOA documents can be found in the recorder’s records. This will include the original documents for Covenants, Codes and Restrictions, and any amendments.

CC and R’s originally were put in place for the benefit of the builder and upon the build out of the subdivision, the Association is turned over, along with any common property, to the residents of the subdivision. There is nothing which requires a HOA; I live in a subdivision built in 1979 and upon the transfer of the “Association” to the residents, the residents promptly voted to abandon the HOA. This document is recorded.

Builders protect their investment by requiring standards so a resident doesn’t paint his house purple or store junk cars in the front yard. This would make the area less desirable for potential buyers and infringe upon the builder’s ability to sell new homes.

HOA dues must be brought up to date if in arrears, prior to transfer of title. Likewise, property taxes will be referenced and must be current prior to transfer of title, including late fees and penalties. The name of the association and management company with contact information is specified.

All liens on the property must be cleared prior to conveyance. And in community property states, the marital status of the buyers are specified. If a married person takes title alone, the spouse must sign a disclaimer deed which is recorded.

And of course any and all mortgages are itemized with the recording number, and including any Home Equity Lines of Credit. And the deed must be recorded from the grantor to the grantee.

Requirements to be fulfilled prior to recordation are itemized as well as the manner in which the documents must be signed, such as margin requirements.

The preliminary title report and commitment for title are important documents and must be read by the buyer, the seller, and both agents so that any errors can be corrected or problems with tile be solved prior to recordation.