What’s the Difference? Title? Escrow?

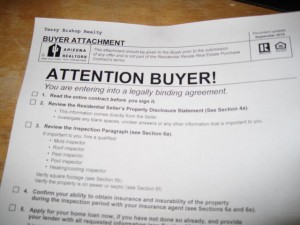

Monday, November 2nd, 2015Arizona is not an attorney state and people purchasing property here who hail from the east coast are often baffled because the Realtor® does everything, there is no attorney involved. If the seller and/or buyer want legal representation, he/she can hire an attorney, but under Arizona statutes, the real estate agent has the power granted to attorneys in other states.

Arizona is often called a “title company” state. It is the title company which investigates the chain of title and provides “title insurance”. If the deed is faulty, it is the title company which must make restitution. In attorney states, it is the attorney who researches the chain of title and does the “closing” which would be the function of escrow companies here in Arizona.

We have talked about preparing the offer for the buyer, how it is going to be financed, when we are going to close escrow, and the appraisal contingency. When the seller’s agent receives an executable contract, that agent “opens escrow”. Evidence of earnest money is taken to the escrow company and “escrow is opened”. A receipt for the earnest money is given to the agent who then should give a copy to the buyer and seller. The escrow company begins the process of checking the documentation and orders title documents from the title company.

In Arizona, escrow company and title company are often used interchangeably. However, they can be different companies. Many of the large real estate companies have relationships with title companies and escrow companies; the information on the contract will read abc title company/xyz agency. Sometimes this is more expensive for the buyer and seller.

The buyer must determine how to take title to the property. There are several methods in Arizona in which to take title with legal and taxable ramifications to each method. Legal and/or tax information cannot be dispensed by the agent or the title company but the agent or title company can give you an informational sheet on methods.

The commitment for title insurance will be delivered to the agent and to the buyer and these documents should be read by both the buyer and the buyer’s agent to insure there is no “clouded title”. Problems with title must be resolved prior to close of escrow. A common problem is a living person who is on title, and the co title holder is deceased. The estate of the deceased must be reconciled prior to transfer of title and any and all taxes paid.

Before listing a property, a good agent will make sure there are no title problems and may ask for a certified death certificate as well as trust documents. When an offer is being negotiated, the horrible title problems will not rear their ugly heads. Sometimes it takes months to clear a title since people must be tracked down and documents must be notarized.

Any exceptions to title insurance must be listed. Title insurance generally covers anything which can be determined from public records. Items not recorded in public records are usually not covered. Deed restrictions, easements, covenants, codes and restrictions should all be public records.

The escrow company must provide the Homeowner’s Association (HOA) information about the buyer and must provide the HOA a closing protection letter indemnifying the buyer and seller from any losses or fraudulent acts by the escrow company. The purchase contract is the instructions to the title and escrow companies.

The buyer has five days from receipt of these documents to review them and disapprove of any item. A buyer who has three 150 pound dogs may want to withdraw from the contract since the HOA regulations permit only one dog weighing no more than 50 pounds. More commonly, a person has an RV or a large truck and will not be permitted to park the vehicle on the property. If in an active adult community, often young children are prohibited for more than an overnight. Grandparents who find themselves caring for grandchildren may have to move from an active adult community or give up caring for their grandchildren. CC and R’s impact the way you can live in your property. Pay attention to them!

The date of close of escrow is the date of proration for taxes, insurances, HOA dues, or other fees. The buyer should make sure all utilities are turned on at the close of escrow so a reconnect fee will not be charged.

If there is a dispute between the buyer and seller regarding any earnest money deposited with the escrow company, the final arbiter is the escrow company. This may arise because one or the other party fails to fulfill the terms of the contract. Each agent may petition the escrow officer on behalf of his/her client, but there is a hold harmless clause indemnifying the escrow company.

The contract provides for assessment liens to be split between buyer and seller, paid in full by either the buyer or seller, but any lien filed after the close of escrow is the responsibility of the buyer.

FIRPTA, the Foreign Investors in Real Property Act, must be complied with at the close of escrow and it is the responsibility of the BUYER to withhold a tax equal to 10% of the purchase price if the seller is a Foreign Person or non resident alien who does not have a tax number.

Realtors® who sell to foreign persons have an ethical responsibility to explain FIRPA and the need to obtain a tax number to these buyers when selling a property in the United States. Trying to comply with the federal mandate when selling a home in order to close escrow is difficult at best.